Social media claims suggest that the European Union intends to seize savings from individuals without informing them and use this money for defense purposes. But what’s actually happening here?

Last week in Brussels Two EU initiatives ignited considerable debate and intense conversations on social media platforms. Initially, the European Commission introduced the White Paper for European Defence – Readiness 2030, designed to facilitate quicker and larger investments from member nations into defense capabilities. defense Secondly, the Commission presented its plan for a savings and investment union aimed at fostering greater encouragement for investments. The initiative seeks to facilitate the creation of European-level funding mechanisms, simplifying the process for individuals to allocate their resources across multiple industries such as environment-focused projects, digital technologies, and defense-related ventures.

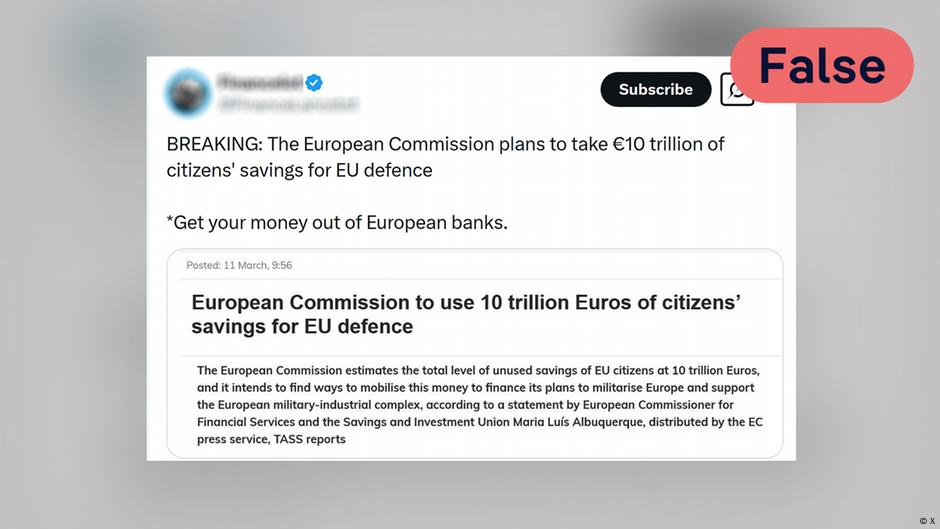

Claim: Social media postings indicated that these new EU proposals posed a threat to the personal savings of Europeans. As an illustration, a user on X commented: " The European Commission intends to seize €10 trillion from citizens’ savings for the purpose of enhancing EU defense. This move could be economically disastrous. *Withdraw your funds from European banks. They might dip into your accounts to fund this initiative.*

Several users on X have posted content with exactly the same message (Example 1, Example 2). Furthermore, concerning videos are being circulated on platforms like YouTube and Telegram (Example 1, Example 2): " The EU is targeting our savings! In the name of ‘defense,’ massive amounts from personal funds are destined to be funneled into the weapons sector. The era of democracy seems over as Brussels and Ursula von der Leyen take charge of how our money is used. Compulsory investments for warfare?

Fact check: False

Can the EU directly access individuals' personal financial resources?

The Savings and Investment Union, introduced on March 19, aims to resurrect a concept that has been discussed for a considerable time: the Capital Markets Union. As stated by Florian Heider, the scientific director at the Leibniz Institute for Financial Research located in Frankfurt am Main, during an interview, this initiative seeks to develop a cohesive financial marketplace across Europe, standardize regulations, remove barriers, and introduce shared investment prospects throughout the continent.

Carsten Brzeski, who leads economics at ING Bank, states, "there is a considerable requirement for investment in Europe which the government cannot cover single-handedly. We also require private investments. Europe holds a large volume of savings in bank accounts earning minimal interest. The key question remains: Could this idle money not be redirected towards more fruitful economic ventures?"

The EU reports that approximately €10 trillion ($10.1 trillion) is presently stored in regular bank accounts throughout Europe. The aim is to encourage individuals to channel their savings into capital markets, such as through investments designed to ensure financial security during retirement. Furthermore, efforts will be made to facilitate greater access to funding for small and medium-sized businesses at the European level. Nonetheless, this initiative has been interpreted by certain social media commentators as a kind of expropriation.

Heider states, 'The funds belong to you. The sole method for the government to obtain individuals' money is via taxation.' He interprets the European Union’s proposal as an effort to enhance clarity and comprehension regarding financial markets. As per Heider, ‘You have no idea how your bank utilizes the money in your savings account; for example, you aren’t aware of the businesses your bank loans money to.’ By engaging in capital-market investments, however, you gain precise control over where your investment goes. According to him, this move by the EU aims at providing greater authority rather than seizing assets.'

Could the EU use citizens' savings for defense investments?

A further allegation suggests that the EU might use contributors’ funds for defense purposes without informing them. Numerous articles on platform X cite a report from the Russian news outlet TASS. The initial statement in the report dated March 5 reads: “The European Commission calculates that the aggregate amount of unutilized savings among EU residents totals €10 trillion, and they aim to identify methods to channel these resources toward financing their initiatives aimed at turning Europe into a more militarized entity and bolstering the European arms industry.”

The proposal implies that the EU's newly formed Savings and Investment Union might appropriate funds from savers for military uses without informing or obtaining permission from them.

The headline in question illustrates an instance of Russian misinformation. As explicitly stated by President von der Leyen, Commissioner Albuquerque, and numerous official documents from the EU Commission, EU citizens retain and will persistently maintain complete liberty to make investments according to their individual preferences; they will consistently possess full authority over deciding how and where to store and distribute their funds,” remarked European Commission spokesman Olof Gill in answer to inquiries.

To put it briefly, those interested in investing in defense have the freedom to do so. However, "no one can compel savers to use their funds in ways they're not comfortable with," according to Brzeski.

Stoking fears

Certain social media assertions promote removing funds from the European Union. In Heider’s view, these statements are intentional misinformation. “The aim here is to undermine Europe. When money leaves Europe, it doesn’t benefit Europe but rather other nations,” he stated. Nonetheless, investments in foreign countries are possible. Yet, the appeal of the eurozone lies in its legal reliability, provision of deposit safeguards, and absence of currency fluctuation risks, as he clarified.

These benefits are acknowledged by international investors as well, with funds now moving into European markets. As Brzeski pointed out, "We're seeing a contrary pattern where capital is shifting from the U.S. to Europe, leading to strong performance in several European stock markets over the past two to three weeks. This has prompted many investors to shift their investments from the U.S. to Europe."

According to the present legal framework, the EU does not have permission to view individuals’ private savings accounts. In fact, numerous European Union regulations aim to safeguard people’s savings. An instance of this is the Deposit Guarantee Scheme, intended to compensate investors should banks encounter failure.

.png)