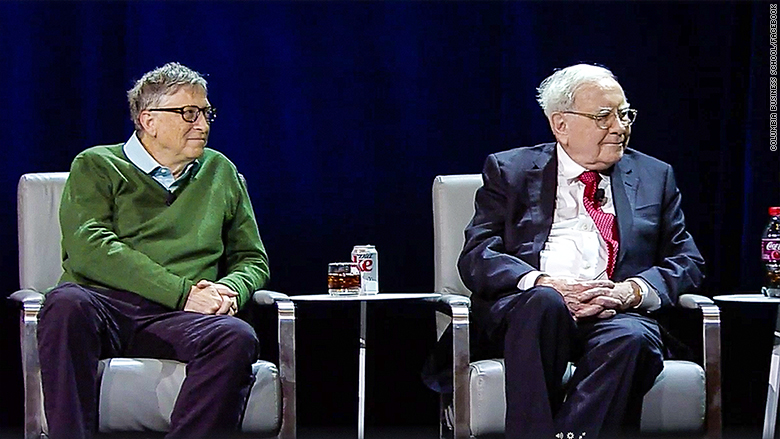

Imagine a world where even the smartest minds can get it wrong. When we delve into Warren Buffett and Bill Gates: Their Most Controversial Predictions Ever , we’re not just looking at financial forecasts or technological leaps; we're peering into the fallibility of even the most celebrated intellects. What happens when the titans of industry miss the mark? This exploration offers valuable lessons in humility, adaptability, and the unpredictable nature of the future , providing unique insights for investors, innovators, and anyone navigating an uncertain world. Explore the surprising misses of Warren Buffett & Bill Gates! Learn about their controversial predictions, the lessons learned, and the ever-changing landscape they navigate.

We are going to unpack some of the predictions made by Warren Buffett and Bill Gates that, in retrospect, didn't quite pan out as expected. This involves digging into the specifics of these forecasts, understanding the contexts in which they were made, and examining why they ultimately deviated from reality. From technological advancements to economic shifts, we'll dissect the factors that contributed to these "misses." It's not about diminishing their achievements, but rather highlighting the complexities of foresight.

The aim here is simple: to learn from the past. By analyzing these predictions, we can gain a deeper understanding of the challenges involved in forecasting future trends and the importance of remaining adaptable in the face of uncertainty. This isn't about pointing fingers or celebrating failures. Instead, it's about extracting valuable lessons that can inform our own decision-making and help us navigate the complexities of the future with greater wisdom.

Ultimately, examining Warren Buffett and Bill Gates: Their Most Controversial Predictions Ever provides a unique window into the unpredictable nature of innovation and the economy. It highlights that even the sharpest minds can be surprised by unforeseen events and shifts in the global landscape. Understanding this fallibility helps us develop a more nuanced perspective on risk, planning, and the importance of continuous learning and adaptation in a constantly evolving world.

The Oracle's Misses: Buffett's Less Fortunate Forecasts

Warren Buffett, known as the "Oracle of Omaha," has a legendary track record in investment. However, even the best make mistakes. Let’s look at some of his predictions that didn't quite hit the bullseye.

The Airline Industry: A Change of Heart

Buffett famously avoided airline stocks for years, calling them a "death trap" for investors. He cited factors like high fixed costs, fierce competition, and susceptibility to external shocks like fuel price increases and economic downturns. He even joked about a fictional capitalist who shot down the Wright brothers’ plane to save investors.

The Turnaround and the Subsequent U-Turn

However, in 2016, Berkshire Hathaway made significant investments in major US airlines, including American, Delta, United, and Southwest. Buffett seemed to have changed his mind, citing consolidation in the industry and a more disciplined approach to capacity management. He believed that airlines had finally learned to control costs and generate sustainable profits.

Why It Went Wrong

The COVID-19 pandemic hit the airline industry incredibly hard. Travel demand plummeted, and airlines faced unprecedented losses. Berkshire Hathaway sold off its entire airline holdings in 2020, admitting that Buffett had made a mistake. The pandemic highlighted the vulnerability of the airline industry to unforeseen global events, reinforcing some of Buffett's initial concerns. The lesson? External factors can dramatically alter even the most carefully considered investment strategies.

IBM: Betting on the Wrong Horse?

In 2011, Berkshire Hathaway started building a significant stake in IBM, a company Buffett admired for its loyal customer base and its role in providing essential services to businesses. He saw IBM as a stable, reliable investment with strong potential for growth.

The Vision and the Reality

Buffett believed that IBM's shift towards cloud computing and its focus on business solutions would drive long-term value. However, IBM struggled to adapt quickly enough to the changing technological landscape. The company faced increased competition from other tech giants, and its revenue growth stalled.

The Exit Strategy

By 2018, Berkshire Hathaway had significantly reduced its stake in IBM, acknowledging that the company's performance had not met expectations. Buffett admitted that he had underestimated the challenges IBM faced and that he had misjudged the company's ability to compete in the rapidly evolving tech industry. This highlights the importance of continuously reassessing investments and adapting to changing market conditions.

Gates' Gaffes: Technological and Societal Predictions

Bill Gates, a visionary in the tech world, has also made his share of predictions that didn't come to fruition.

Spam: Vanquished by 2006?

In 2004, Bill Gates famously declared that spam would be a thing of the past within two years. He predicted that technological advancements, such as better filtering techniques and authentication methods, would effectively eliminate unsolicited emails.

The Optimistic Outlook

Gates believed that Microsoft and the broader tech industry would be able to develop solutions to combat spam and protect users from unwanted messages. He envisioned a future where email communication would be cleaner, more efficient, and less cluttered with spam.

The Reality Check

Despite significant progress in spam filtering and security measures, spam remains a persistent problem even today. While the volume of spam has fluctuated over time, it has not been eradicated. Spammers have continued to evolve their tactics, finding new ways to bypass filters and reach users' inboxes. The fight against spam is an ongoing arms race, and Gates' prediction proved overly optimistic.

Windows Vista: A Smooth Transition?

The launch of Windows Vista in 2007 was intended to be a major step forward for Microsoft's operating system. However, the release was plagued with problems, including compatibility issues, performance bottlenecks, and user dissatisfaction.

The Promise and the Problems

Vista was designed to be a more secure and user-friendly operating system, but its demanding hardware requirements and software compatibility issues led to widespread frustration. Many users experienced slow performance, frequent crashes, and difficulties running their existing applications.

The Fallout

The negative reception to Windows Vista damaged Microsoft's reputation and led many users to stick with Windows XP or migrate to Apple's macOS. The Vista debacle served as a cautionary tale about the importance of thorough testing, user feedback, and realistic expectations in software development. It highlights that even a company as powerful as Microsoft can stumble when introducing new technology.

Analyzing the Misses: Common Threads and Key Takeaways

What can we learn from these forecasting failures? Several common threads emerge:

The Unpredictability of External Events

Both Buffett and Gates were affected by unforeseen external events that disrupted their predictions. The COVID-19 pandemic decimated the airline industry, undermining Buffett's investment thesis. Similarly, the ever-evolving tactics of spammers proved more resilient than Gates anticipated.

The Pace of Technological Change

The rapid pace of technological change can make it difficult to predict future trends accurately. IBM struggled to keep up with the competition in the cloud computing market, while Microsoft underestimated the challenges of creating a seamless user experience with Windows Vista.

The Importance of Humility and Adaptability

Even the most successful investors and innovators can make mistakes. The key is to learn from these mistakes, adapt to changing circumstances, and remain humble in the face of uncertainty. Buffett and Gates have both demonstrated a willingness to admit their errors and adjust their strategies accordingly.

FAQ: Decoding the Predictions of Titans

Let's dive into some frequently asked questions about Warren Buffett and Bill Gates: Their Most Controversial Predictions Ever .

What makes a prediction "controversial"?

A prediction becomes controversial when it goes against conventional wisdom, challenges established beliefs, or carries significant potential consequences. It often involves a degree of risk or uncertainty, and its outcome can spark debate and discussion.

Why should we care about the predictions of billionaires?

While their wealth doesn't guarantee accuracy, individuals like Buffett and Gates have access to extensive resources, networks, and expertise. Their predictions often reflect deep insights into market trends, technological advancements, and societal shifts. Studying their forecasts, even the incorrect ones, can provide valuable lessons about decision-making, risk assessment, and the challenges of navigating an uncertain future.

Were these predictions necessarily "failures"?

Not necessarily. Even if a prediction doesn't come true, the process of making it can be valuable. It forces one to analyze data, consider different scenarios, and challenge assumptions. The insights gained from this process can inform future decisions, even if the initial forecast proves inaccurate.

What broader lessons can be drawn from these experiences?

The Importance of Continuous Learning: The world is constantly changing, so it's essential to stay informed and adapt to new information. The Value of Diversification: Don't put all your eggs in one basket. Diversifying your investments and strategies can help mitigate risk. The Need for Humility: Recognize that you don't have all the answers and be willing to admit when you're wrong. The Power of Resilience: Learn from your mistakes and bounce back stronger than before.

How do Buffett and Gates approach risk?

Buffett is known for his value investing approach, which involves buying undervalued companies with strong fundamentals. He focuses on long-term growth and avoids speculative investments. Gates, on the other hand, is more willing to take risks on innovative technologies and philanthropic ventures. Both approaches involve careful analysis and a willingness to accept calculated risks.

What role does luck play in their success?

While skill and expertise are essential, luck also plays a role in success. Unforeseen events, market fluctuations, and technological breakthroughs can all impact outcomes. However, successful individuals like Buffett and Gates are able to capitalize on opportunities and navigate challenges effectively, regardless of luck.

Has their approach to predictions changed over time?

It's likely that both Buffett and Gates have refined their approach to predictions over time, based on their experiences and the changing landscape. They have likely become more aware of the limitations of forecasting and more focused on adapting to unforeseen circumstances.

Conclusion: The Value of Imperfect Foresight

Analyzing Warren Buffett and Bill Gates: Their Most Controversial Predictions Ever isn't about celebrating their mistakes. It’s about recognizing the inherent challenges of predicting the future, even for the brightest minds. Their experiences highlight the importance of adaptability, continuous learning, and a healthy dose of humility. By studying their successes and failures, we can gain valuable insights that inform our own decision-making and help us navigate the complexities of an ever-changing world. Ultimately, understanding that even the experts can be wrong empowers us to think critically, challenge assumptions, and forge our own paths with greater confidence.

.png)