Navigating the world of student loans can feel like wading through a dense fog. You're not alone if you're constantly wondering about the best way to tackle that looming debt. With so many options available, it's easy to feel overwhelmed and confused. This article helps you understand the nuances of student loan management. Are you struggling to make your monthly payments? You might be curious about Student Loan Forgiveness vs Repayment Plans: Which Is Better?

Understanding your options is the first step to financial freedom. We'll explore the key differences between student loan forgiveness programs and income-driven repayment plans, helping you make an informed decision about which path aligns best with your individual circumstances and financial goals. We’ll examine the eligibility requirements, the pros and cons, and potential long-term implications of each approach. Get ready to take control of your student loan debt and pave the way for a brighter financial future.

So, which path is right for you: pursuing student loan forgiveness or enrolling in a repayment plan? The answer depends on a multitude of factors, including your career path, income level, and risk tolerance. For those working in public service, loan forgiveness programs like Public Service Loan Forgiveness (PSLF) may offer a faster route to debt relief. On the other hand, income-driven repayment plans provide a safety net for borrowers with lower incomes, ensuring manageable monthly payments. Let’s dive in and figure out the best strategy for your specific situation.

Ultimately, the choice between student loan forgiveness and repayment plans hinges on careful consideration of your unique circumstances. If you qualify for forgiveness programs and are committed to a career in public service, this may be the most advantageous option. Conversely, if you prioritize flexibility and want to ensure manageable monthly payments regardless of your employment situation, income-driven repayment plans could be the better fit. By understanding the nuances of each option, you can make a well-informed decision that sets you on the path to financial well-being and resolves the dilemma of Student Loan Forgiveness vs Repayment Plans: Which Is Better?

Understanding Student Loan Forgiveness

What is Student Loan Forgiveness?

Student loan forgiveness is a government program designed to alleviate student loan debt for borrowers who meet specific criteria. These programs typically require borrowers to work in certain professions, such as teaching, nursing, or public service, for a set period while making qualifying loan payments. After the required period, the remaining loan balance is forgiven. It's a way to reward those who dedicate their careers to serving the community while also addressing the rising burden of student loan debt. Essentially, you get a portion or all of your loans wiped away after fulfilling certain obligations. Think of it as a thank you for contributing to society in a meaningful way.

Types of Student Loan Forgiveness Programs

There are several types of student loan forgiveness programs available, each with its own set of eligibility requirements. The most common include:

Public Service Loan Forgiveness (PSLF): This program is for borrowers employed by a government organization or a qualifying non-profit organization. To be eligible, borrowers must make 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Teacher Loan Forgiveness: This program is available to teachers who teach full-time for five consecutive academic years in a low-income school or educational service agency. Eligible teachers can receive up to \$17,500 in loan forgiveness.

Income-Driven Repayment (IDR) Forgiveness: While technically a repayment plan, IDR plans offer forgiveness after a set period (typically 20 or 25 years) of making qualifying payments. These plans adjust your monthly payment based on your income and family size.

Eligibility Requirements for Forgiveness

Each loan forgiveness program has its own specific eligibility requirements. For PSLF, you need to be employed full-time by a qualifying employer and make 120 qualifying payments. Teacher Loan Forgiveness requires five consecutive years of teaching in a low-income school. IDR forgiveness requires enrollment in an IDR plan and making payments for the specified term. It's crucial to carefully review the requirements for each program to determine if you qualify. Don't just assume you're eligible; do your homework!

Pros and Cons of Student Loan Forgiveness

Like any financial decision, student loan forgiveness has its advantages and disadvantages:

Pros: Significant Debt Relief: The most obvious benefit is the potential to have a significant portion of your student loan debt forgiven.

Encourages Public Service: It incentivizes people to work in crucial public service roles.

Financial Freedom: Reduced debt can free up cash flow for other financial goals, like buying a home or saving for retirement.

Cons: Strict Eligibility Requirements: Meeting the eligibility requirements can be challenging, especially for PSLF, which has had a historically low approval rate.

Long Commitment: Forgiveness often requires a long-term commitment to a specific job or repayment plan.

Tax Implications: Depending on the program and your state, the forgiven amount may be considered taxable income.

Example of Student Loan Forgiveness

Let's say Sarah is a teacher working at a low-income school. She has \$50,000 in student loan debt. After teaching for five consecutive years, she qualifies for Teacher Loan Forgiveness, receiving up to \$17,500 in loan forgiveness. This significantly reduces her debt burden and provides her with financial relief.

Understanding Student Loan Repayment Plans

What are Student Loan Repayment Plans?

Student loan repayment plans are structured programs designed to help borrowers manage their student loan debt by spreading payments over a longer period. These plans aim to make monthly payments more affordable by adjusting the repayment term or basing payments on income. Unlike loan forgiveness, repayment plans don't necessarily lead to complete debt cancellation, but they can provide much-needed flexibility and affordability. They're a lifeline for many borrowers struggling to keep up with their loan obligations.

Types of Repayment Plans

There are several types of repayment plans available, including:

Standard Repayment Plan: This plan has a fixed monthly payment and repays your loan in 10 years.

Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time, typically every two years.

Extended Repayment Plan: This plan allows you to repay your loan over a longer period, up to 25 years.

Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payment based on your income and family size. Common IDR plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

How Repayment Plans Work

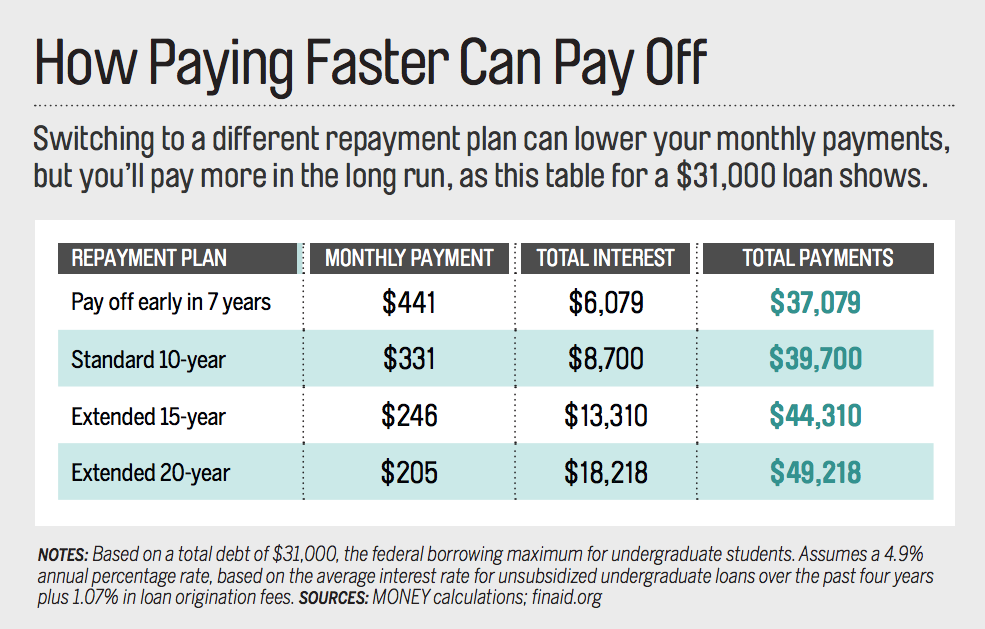

Repayment plans work by restructuring your loan terms to make monthly payments more manageable. The Standard Repayment Plan is the simplest, with fixed payments over a 10-year period. The Graduated Repayment Plan is designed for borrowers who expect their income to increase over time, starting with lower payments that gradually rise. The Extended Repayment Plan stretches out the repayment period, resulting in lower monthly payments but more interest paid over the life of the loan. IDR plans are the most flexible, as they adjust your payments based on your income and family size, ensuring your payments are affordable even if your income is low.

Eligibility for Repayment Plans

Eligibility for repayment plans varies depending on the type of plan. The Standard, Graduated, and Extended Repayment Plans are generally available to most borrowers. However, IDR plans have specific income requirements. Generally, to qualify for an IDR plan, your monthly payments under the Standard Repayment Plan must be higher than what you would pay under the IDR plan. This ensures that the IDR plan is providing genuine relief based on your financial situation.

Pros and Cons of Repayment Plans

Repayment plans offer several benefits and drawbacks:

Pros: Affordable Payments: Repayment plans can significantly lower your monthly payments, making them more manageable. Flexibility: IDR plans offer flexibility by adjusting your payments based on your income. Avoid Default: By enrolling in a repayment plan, you can avoid defaulting on your student loans.

Cons: Longer Repayment Period: Repayment plans often extend the repayment period, resulting in more interest paid over the life of the loan. Potential for Higher Overall Cost: Due to the longer repayment period and accrued interest, you may end up paying more overall compared to the Standard Repayment Plan. Complexity: Navigating the various repayment plan options can be confusing and time-consuming.

Example of Student Loan Repayment Plan

John has \$60,000 in student loan debt. Under the Standard Repayment Plan, his monthly payments would be \$660. However, John's income is low, so he enrolls in the Income-Based Repayment (IBR) plan. His monthly payments are reduced to \$300, making his debt much more manageable. While he will pay more interest over the life of the loan, the lower monthly payments allow him to cover his essential expenses and avoid default.

Student Loan Forgiveness vs Repayment Plans: Which Is Better?

Factors to Consider

Choosing between student loan forgiveness and repayment plans depends on several factors, including your:

Career Path: If you work in public service or a qualifying profession, loan forgiveness may be the better option. Income Level: If you have a low income, IDR plans can provide much-needed relief. Risk Tolerance: Forgiveness programs often have strict requirements, while repayment plans offer more flexibility. Financial Goals: Consider your long-term financial goals when making your decision.

Scenarios Where Forgiveness Is Better

Loan forgiveness is generally the better option if:

You work in a qualifying public service job and are committed to staying in that field for the required period. You meet all the eligibility requirements for a forgiveness program. You are comfortable with the potential for your forgiven amount to be considered taxable income.

Scenarios Where Repayment Plans Are Better

Repayment plans are generally the better option if:

You don't qualify for loan forgiveness programs. You want more flexibility in your career choices. You prefer lower monthly payments, even if it means paying more interest over the life of the loan. You want to avoid the strict eligibility requirements of forgiveness programs.

Step-by-Step Guide to Choosing the Right Option

1. Assess Your Eligibility: Determine if you qualify for any loan forgiveness programs.

2. Evaluate Your Income and Expenses: Calculate your monthly income and expenses to determine how much you can afford to pay towards your student loans.

3. Consider Your Career Goals: Think about your long-term career goals and whether they align with the requirements of forgiveness programs.

4. Compare Your Options: Use the Education Department's loan simulator to compare the costs and benefits of different repayment plans and forgiveness programs.

5. Consult with a Financial Advisor: If you're still unsure, consult with a financial advisor who can provide personalized advice based on your individual circumstances.

Common Mistakes to Avoid

Ignoring Eligibility Requirements: Carefully review the eligibility requirements for each program before applying. Failing to Recertify: Many IDR plans require annual recertification of your income and family size. Not Keeping Records: Maintain detailed records of your payments and employment history, especially if you're pursuing loan forgiveness. Procrastinating: Don't wait until you're in financial trouble to explore your options.

Frequently Asked Questions (FAQ)

Loan Forgiveness FAQs

Will My Forgiven Loan Amount Be Taxed?

Whether or not your forgiven loan amount will be taxed depends on the specific forgiveness program and applicable tax laws. As of now, student loan forgiveness through programs like Public Service Loan Forgiveness (PSLF) is generally not considered taxable income under federal law. However, forgiveness received through Income-Driven Repayment (IDR) plans may be taxed as income. Additionally, state tax laws vary, so it's essential to check with your state's tax authority or a tax professional to understand the potential tax implications. This is super important to know because, depending on the amount forgiven, the tax bill could be substantial.

What Happens If I Don't Meet the Requirements for Loan Forgiveness?

If you fail to meet the requirements for loan forgiveness, such as not completing the required years of service or not making enough qualifying payments, your loans will not be forgiven. In this case, you'll need to continue repaying your loans under a different repayment plan. It's crucial to closely monitor your progress toward meeting the forgiveness requirements and to have a backup plan in place in case you don't qualify. Don't get discouraged; there are still options for managing your debt.

Can I Get Forgiveness on Private Student Loans?

Generally, no , most student loan forgiveness programs are specifically for federal student loans. Private student loans typically do not qualify for federal forgiveness programs like PSLF or IDR forgiveness. However, some private lenders may offer their own version of loan assistance programs, so it's worth checking with your lender to see if any options are available. It's a long shot, but it never hurts to ask!

Repayment Plan FAQs

How Do I Enroll in an Income-Driven Repayment (IDR) Plan?

To enroll in an Income-Driven Repayment (IDR) plan, you'll need to apply through the Education Department's website. The application process typically involves providing information about your income, family size, and loan details. The Education Department will then determine which IDR plan is the best fit for you based on your circumstances. It's a pretty straightforward process, but make sure you have all the necessary documents handy before you start.

Can My Payments Increase Under an IDR Plan?

Yes , your payments under an IDR plan can increase or decrease depending on changes in your income or family size. IDR plans require annual recertification, during which you'll need to update your income and family information. If your income increases, your monthly payments will likely increase as well. Conversely, if your income decreases or your family size increases, your payments may be reduced. This flexibility is one of the key benefits of IDR plans.

What Happens If I Can't Afford My Payments Under Any Repayment Plan?

If you're struggling to afford your payments under any repayment plan, including IDR plans, you may want to consider applying for a deferment or forbearance. Deferment allows you to temporarily postpone your loan payments, while forbearance allows you to temporarily reduce or postpone your payments. However, interest may continue to accrue on your loans during deferment or forbearance, so it's important to understand the long-term implications. This should be a last resort, but it's good to know it's there if you really need it.

General Student Loan FAQs

What is the Difference Between Loan Deferment and Forbearance?

Loan deferment and forbearance are both temporary relief options that allow you to postpone or reduce your student loan payments. The main difference is that deferment is typically available if you meet specific eligibility requirements, such as being unemployed or enrolled in school. Forbearance, on the other hand, is generally available if you're experiencing financial hardship, regardless of whether you meet specific eligibility criteria. Also, interest may continue to accrue during forbearance, potentially increasing your overall debt.

How Do I Find Out What Types of Federal Student Loans I Have?

You can find out what types of federal student loans you have by logging into your account on the National Student Loan Data System (NSLDS) website. The NSLDS provides a comprehensive overview of your federal student loan information, including loan types, balances, interest rates, and servicer contact information. This is a super handy tool for keeping track of your loans.

Where Can I Get Help With My Student Loans?

There are several resources available to help you with your student loans. You can contact your loan servicer directly for assistance with repayment options, deferment, or forbearance. You can also consult with a financial advisor who specializes in student loan debt management. Additionally, the Education Department offers a wealth of information and resources on its website. Don't be afraid to reach out for help; there are plenty of people who want to support you.

Conclusion

Choosing between student loan forgiveness and repayment plans requires careful consideration of your individual circumstances and financial goals. If you are committed to a career in public service and meet the eligibility requirements for forgiveness programs, this option may offer the fastest path to debt relief. However, if you value flexibility and want to ensure manageable monthly payments regardless of your employment situation, income-driven repayment plans could be a better fit. Remember to assess your eligibility, evaluate your income and expenses, and compare your options before making a decision. By understanding the nuances of Student Loan Forgiveness vs Repayment Plans: Which Is Better? , you can take control of your student loan debt and pave the way for a brighter financial future. Don't let the burden of student loans weigh you down – empower yourself with knowledge and make an informed choice that aligns with your long-term aspirations.

.png)